The complete guideline of how subcontracting works in ERPNext is provided here.

In this blog we will explore the various documents involved in the subcontracting process and delve into different scenarios, offering a clear understanding of its practical applications and workflows for Indian Compliance.

What is Subcontracting ??

Subcontracting, or job work, allows businesses to send raw materials or semi- finished goods to external vendors for further processing or assembly, enabling efficient resource utilization. This approach helps companies focus on core activities while leveraging external expertise to reduce production costs and increase flexibility in scaling operations.

ITC-04 Reporting for Subcontracting

Form GST ITC-04 must be submitted by the principal every quarter. He must include the details of challans in respect of the following-

- Goods dispatched to a job worker or

- Received from a job worker or

- Sent from one job worker to another

Details to be furnished in ITC-04

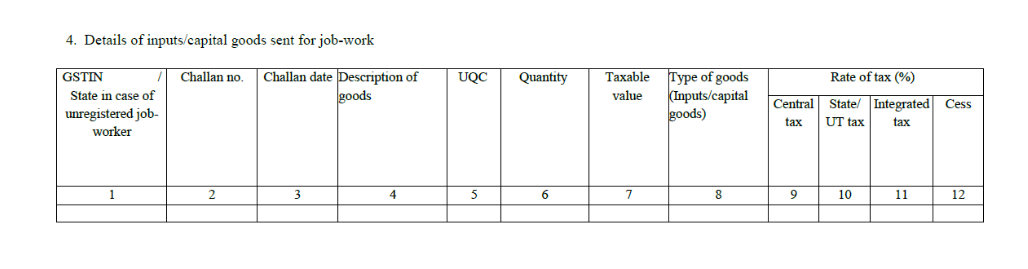

- Goods sent to job worker (Table-4)

Various details must be mentioned such as GSTIN, challan number, tax amount etc. All details will be available from the challans.

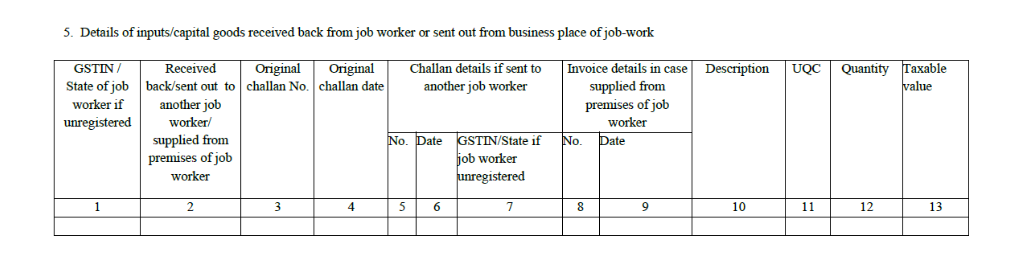

- Goods received back from the job worker (Table-5)

The details of goods received back will be mentioned here. The goods may be received by the principal or sent to another job worker directly from the first job worker’s place of business. All details of original challans and new challans must be mentioned.

Refer here to learn how ITC-04 reporting is managed in ERPNext for Indian Compliance.

Subcontracting Workflow

Items

Service Item: This item is used to record and charge the service cost associated with the job work process, reflecting the labor or services provided by the Job Worker.

Raw Materials/Capital Goods: In subcontracting, Raw Materials are items that are provided to a subcontractor to be processed into a semi-finished or finished product. Whereas, Capital Goods are tangible assets that a company uses to produce goods and services, such as buildings, machinery, equipment, vehicles, and tools.

Finished Item: This refers to the final product that is produced as a result of the job work process.

Bill of Material

A Bill of Materials (BOM) is a comprehensive document that outlines all the raw materials, components, and parts required to manufacture a product, along with the precise quantities for each. It serves as a detailed blueprint for the production process, ensuring accuracy and consistency in material planning and assembly.

Let's consider a simple example, where you manufacture a pen. The processed pen will be named under the Bill of Materials(BOM), whereas, the nib, plastic, ink, etc. will be categorized as sub-items.

Purchase Order

In the subcontracting workflow, the Purchase Order primarily documents the service received from the job worker for the job work performed. It ensures proper tracking of the subcontracted services and acts as a formal record of the transaction.

Subcontracting Order

A Subcontracting Order outlines the requirements for the finished goods to be produced by the subcontractor after job work is performed. It details what will be obtained from the subcontracting process, along with the specifications for the raw materials used.

Stock Entry

A Stock Entry tracks the transfer of goods from your warehouse to the supplier, documenting the movement of inventory and ensuring accurate records of stock levels throughout the process.

Subcontracting Receipt

Subcontracting Receipt is used to receive items from your supplier. You must specify the Supplier Warehouse from which the raw materials will be taken and indicate the Accepted Warehouse where the finished goods will be received. This process can be thought of as a backflush for subcontracting, streamlining inventory management by automatically adjusting stock levels for both raw materials and finished products.

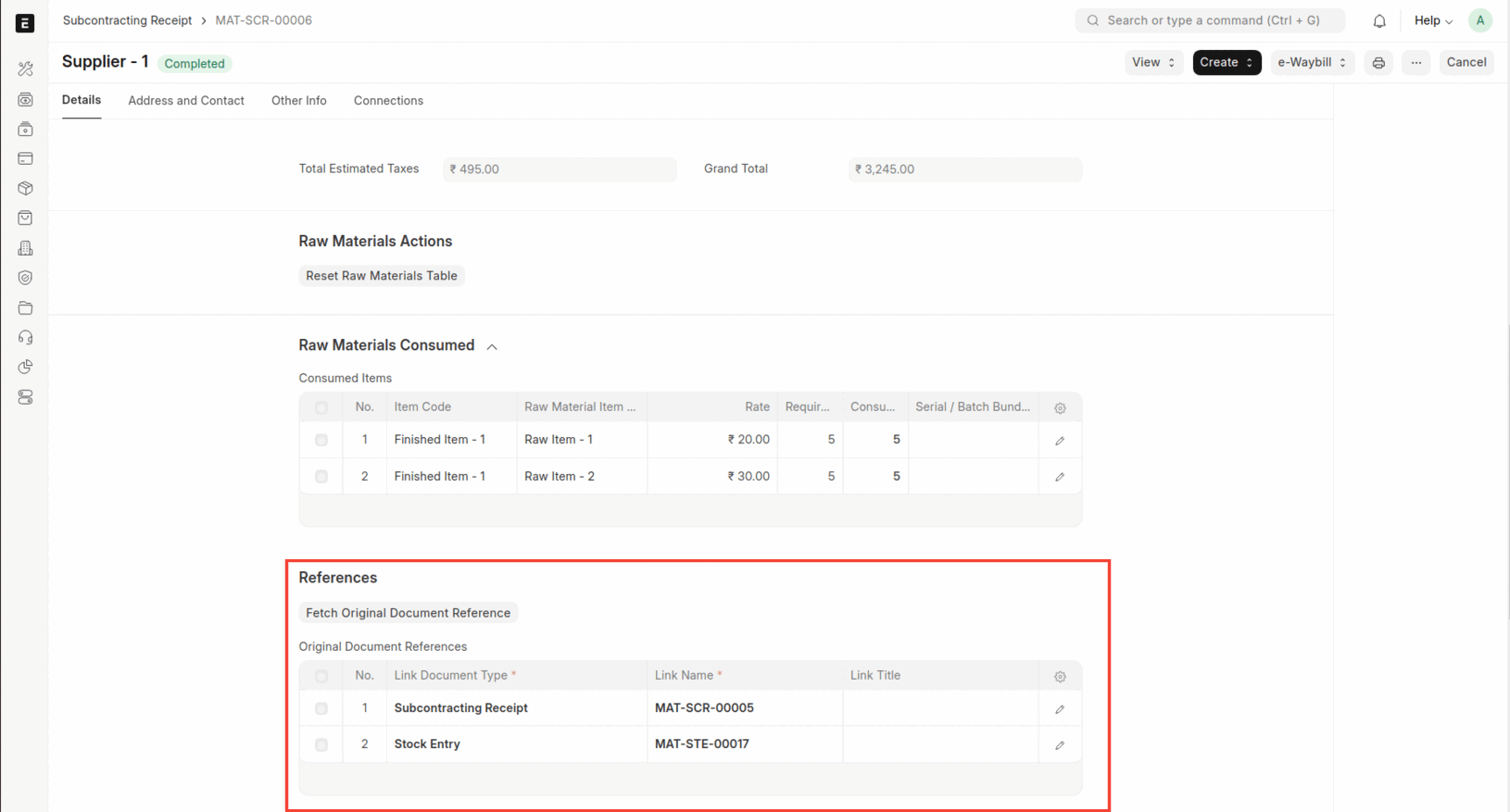

Link the receipt with the Stock Entries and the Subcontracting Returns in Doc References to maintain clear documentation of the transactions associated with the receipt. This ensures that all relevant information required for ITC-04 Reporting is accurately recorded and tracked.

Refer here to learn how to enable e-Waybill generation for Subcontracting in ERPNext for Indian Complaince.

Subcontracting Scenarios

Resend the Finished Good for Rework

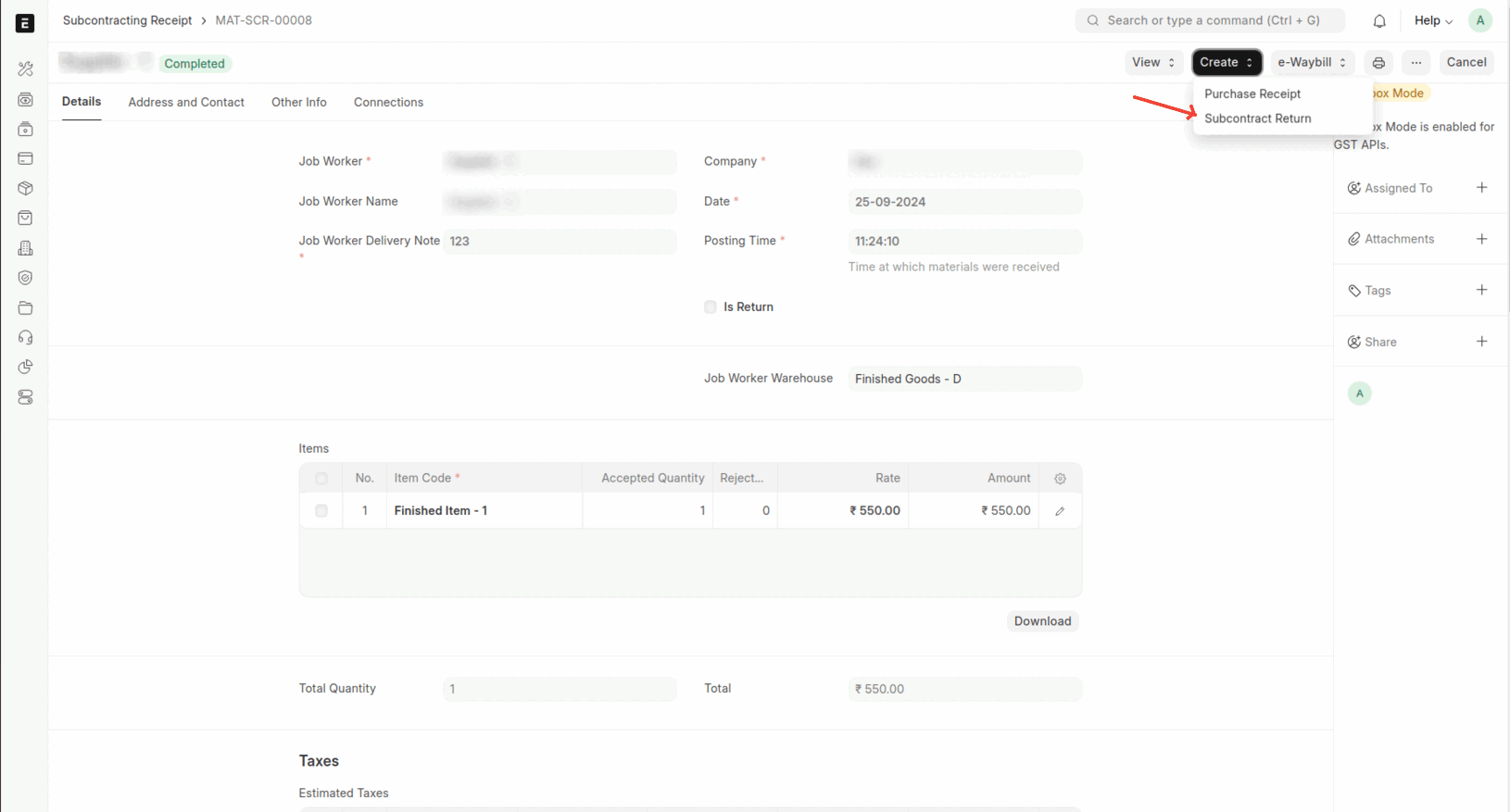

When the finished goods are received back from the supplier and require some rework, they must be sent back to the supplier for further processing. This process can be effectively managed in ERPNext through Subcontract Returns, which allows for the documentation and tracking of items being returned to the subcontractor for additional modifications or adjustments.

- From the Subcontracting Receipt, generate Subcontract Returns for the finished goods that need to be sent to the supplier. This transaction will be included in Table-4 for ITC-04 Reporting.

- Create a stock entry return from the subcontracting order if any raw materials need to be sent back to the supplier along with the finished goods.

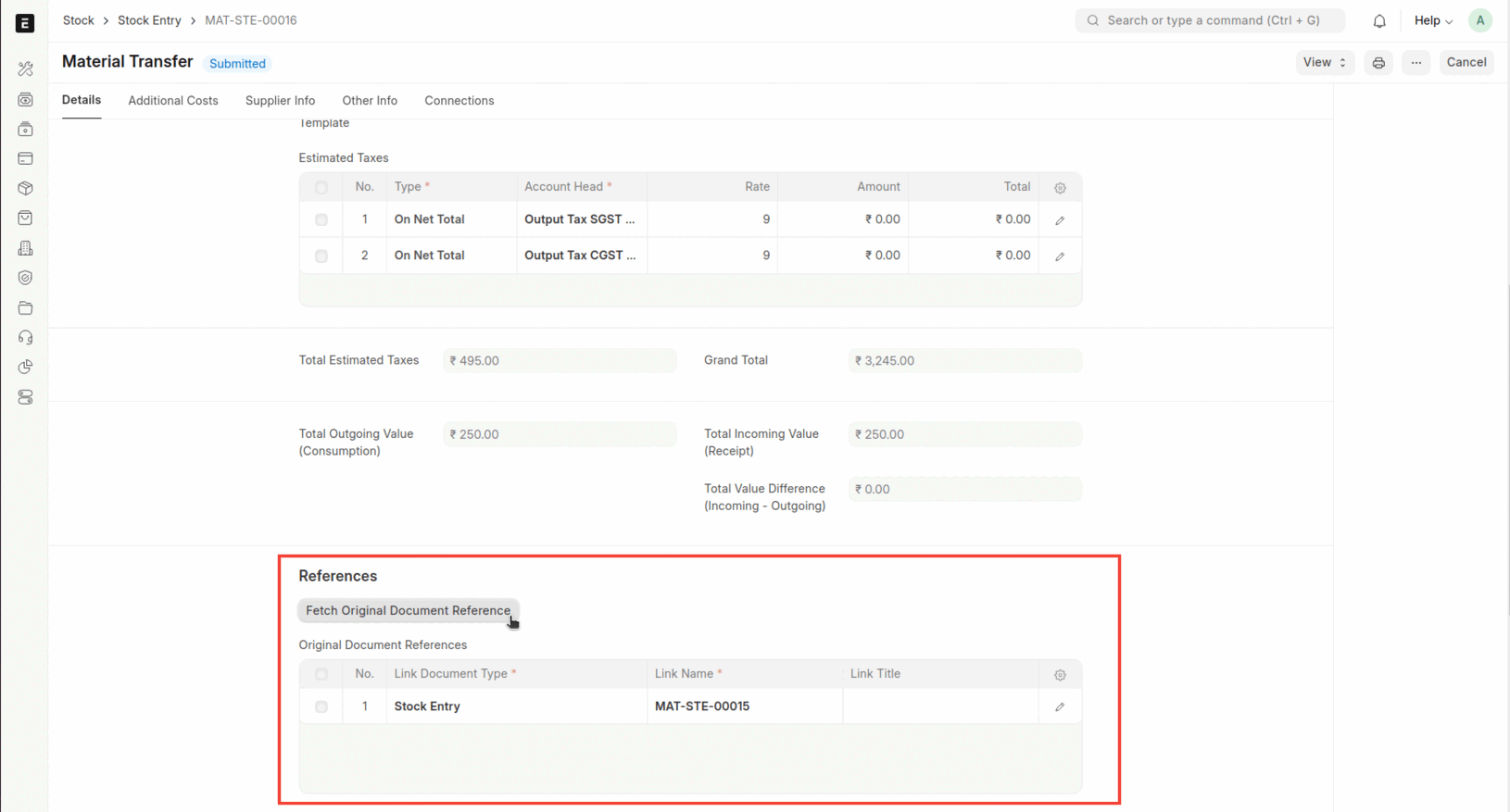

- Link the stock entry against which the stock entry return is made in the Doc References section of the stock entry return, which will be useful for Original Challan Reference that will be used in Table-4 for ITC-04 Reporting.

- Finally, receive the returned goods through the subcontracting receipt to complete the process cycle.

- Link the stock entries and subcontracting returns associated with the subcontracting receipt in the Doc References. This transaction will be included in Table-5 for ITC-04 Reporting.

Multilevel Subcontracting Process

Multi-Level Subcontracting refers to a complex manufacturing process where multiple subcontractors are involved in the production of a final product. In this setup, primary subcontractors may outsource certain tasks to secondary subcontractors, creating a layered supply chain.

For Example, a furniture manufacturer, XYZ (Warehouse-X), produces unfinished wooden chairs in-house and then outsources further processing. Subcontractor-A (Warehouse-A) stains and finishes the chairs, while Subcontractor-B (Warehouse-B) assembles the cushions.

Here's how the multi-level subcontracting process can be implemented in ERPNext:

Initial Subcontracting: Company XYZ initiates the process by creating a Purchase Order and a Subcontracting Order for Subcontractor-A. A stock entry is generated to transfer raw materials from Warehouse-X to Warehouse-A. This transaction will be included in Table-4 for ITC-04 Reporting.

Completion by Subcontractor-A: Upon completion of the job work, Subcontractor-A creates a Subcontracting Receipt for Warehouse-A to Warehouse-A to formally receive the first part of finished goods. This transaction will be included in Table-5 for ITC-04 Reporting.

Further Subcontracting: Subcontractor-A then creates Purchase Order and Subcontracting Order for subcontracting by Subcontractor-B, along with a stock entry to transfer goods from Warehouse-A to Warehouse-B. This transaction will be included in Table-5 for ITC-04 Reporting.

Completion by Subcontractor-B: After Subcontractor-B completes the work, Company XYZ creates a Subcontracting Receipt to receive goods from Warehouse-B to Warehouse-X. This transaction will be included in Table-5 for ITC-04 Reporting.

This process effectively completes the multi-level subcontracting workflow in ERPNext

Excess Raw Materials Return

When all raw materials sent to a job worker are not utilized, they need to be returned. This process can be managed in ERPNext using Stock Entry Returns.

The initial steps for sending goods to the subcontractor remains the same.

A Stock Entry Return must be created to receive back the unused raw materials, and it should be linked to the original stock entry under Doc References which will be used as original challan in Table-5 for ITC-04 Reporting.

Finally, receive the finished goods through the Subcontracting Receipt to complete the process cycle.This transaction will be included in Table-5 for ITC-04 Reporting.

INFO

There is a time limit for the principal manufacturer to receive goods:

- Capital Goods- 3 years from effective date

- Input Goods- 1 year from effective date

In case goods are not received within the period as mentioned above, such goods will be deemed as supply from the effective date. The principal manufacturer will have to pay tax on such deemed supply. The challan issued will be treated as an invoice for such supply.