Lower Deduction Certificate

According to the tax withholding category, a person responsible for making payments is required to deduct tax at source at prescribed rates. Instead of receiving tax on your income from you at a later date, the government wants the payers to deduct tax beforehand and deposit it with the government. However, this scheme of deducting tax at source may cause issues for a few taxpayers who may not have taxable income for that fiscal year.

Therefore, for such taxpayers, the government provides an option to obtain a certificate confirming either a lower rate or NIL rate of TDS compared to the rate specified in the tax withholding category.

Prerequisites

Before creating and using a Lower Deduction Certificate, it is advised to create and study the following first:

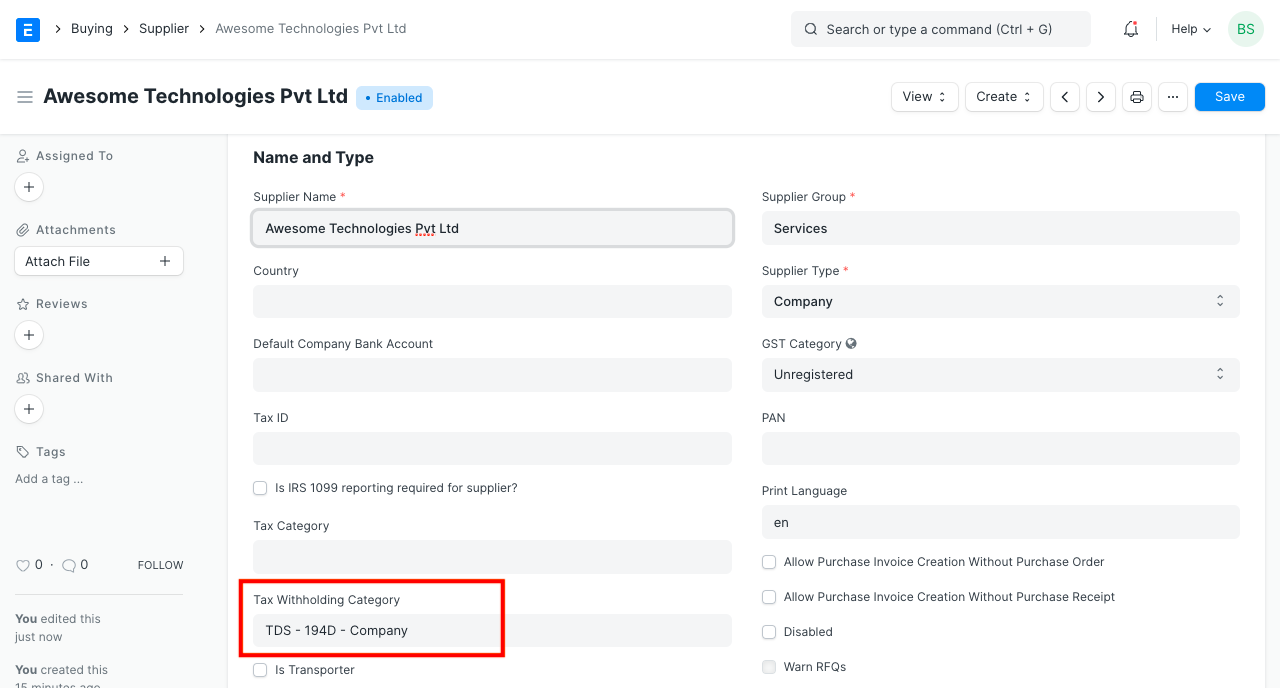

- Supplier

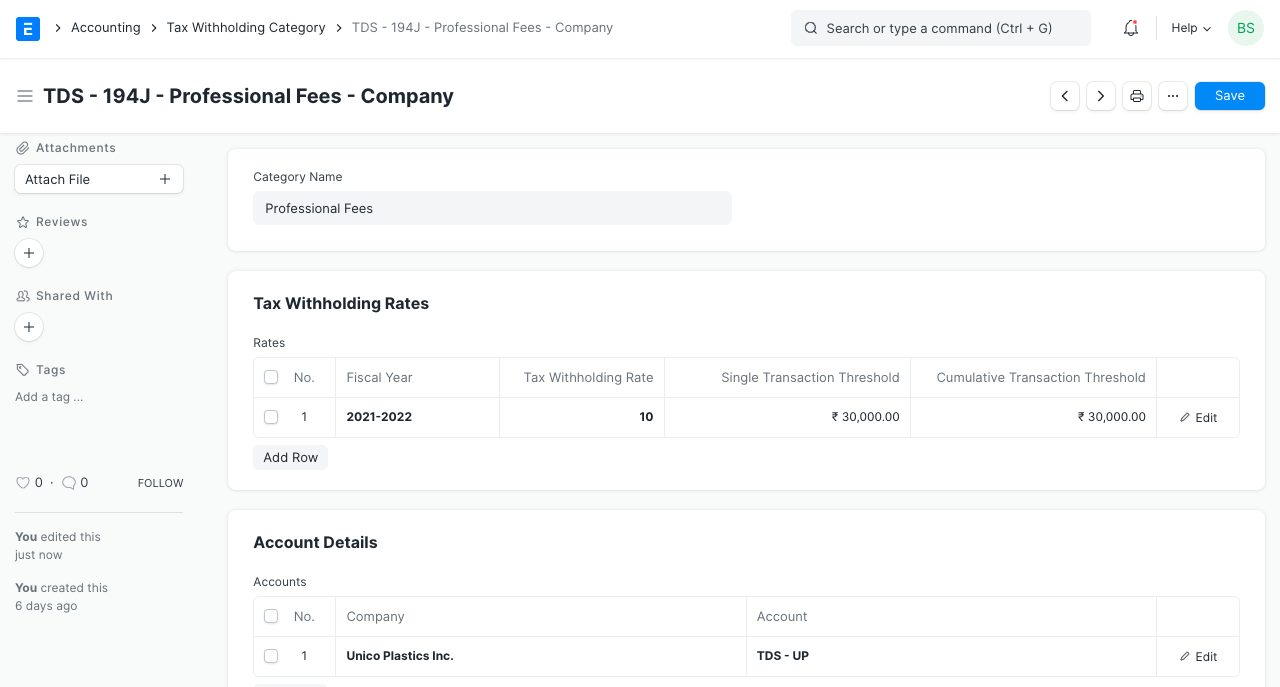

- Tax Withholding Category

How to create a Lower Deduction Certificate

- Go to the Lower Deduction Certificate list and click on New.

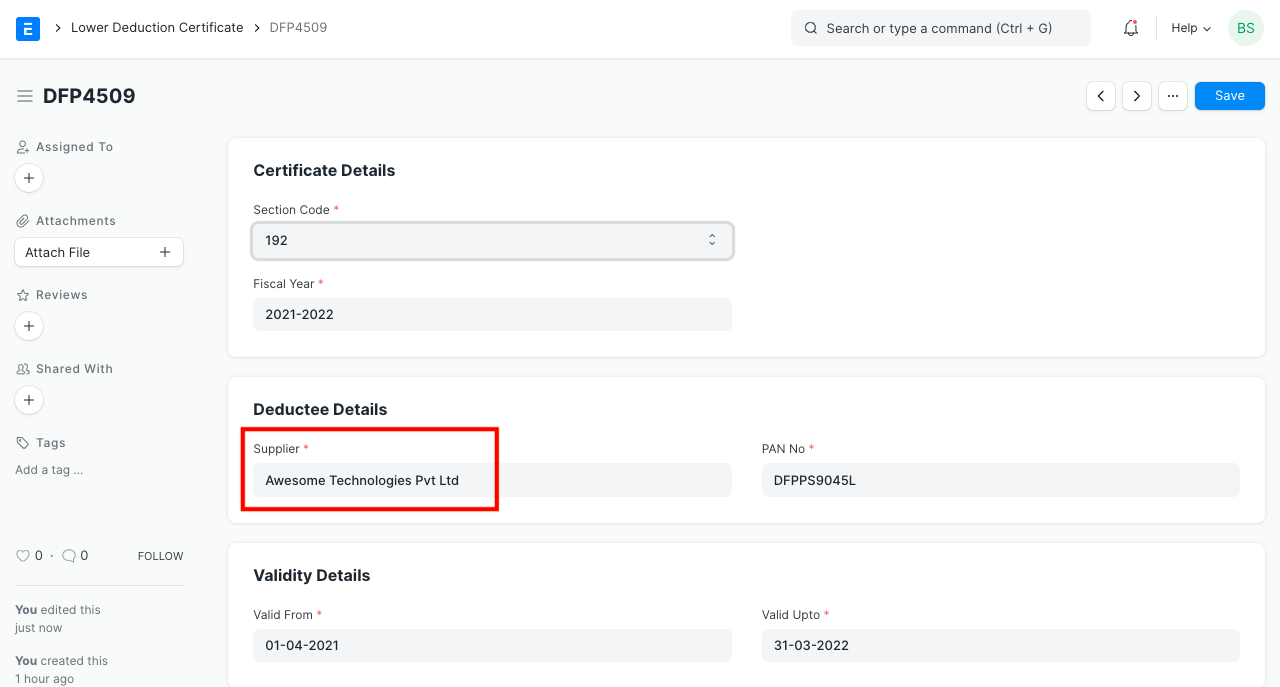

- Enter the Certificate No.

- Select the Section Code.

- Enter the Fiscal Year.

- Select the Supplier having a valid PAN number. PAN number will be auto-fetched on the selection of Supplier.

- Enter Valid From and Valid Up To dates.

- Enter the rate of TDS as per the certificate and the certificate limit.

- Click on Save.

Using Lower Deduction Certificate

Use in Purchase Invoice

In the following example, we have selected TDS category as 'TDS - 194D - Individual' which has a rate of 5%.

Set the Tax Withholding Category for the Supplier in the supplier master. Then upon selecting that Supplier, a checkbox will become visible in the Purchase Invoice to select whether to apply tax or not and the TDS category will be auto-fetched.

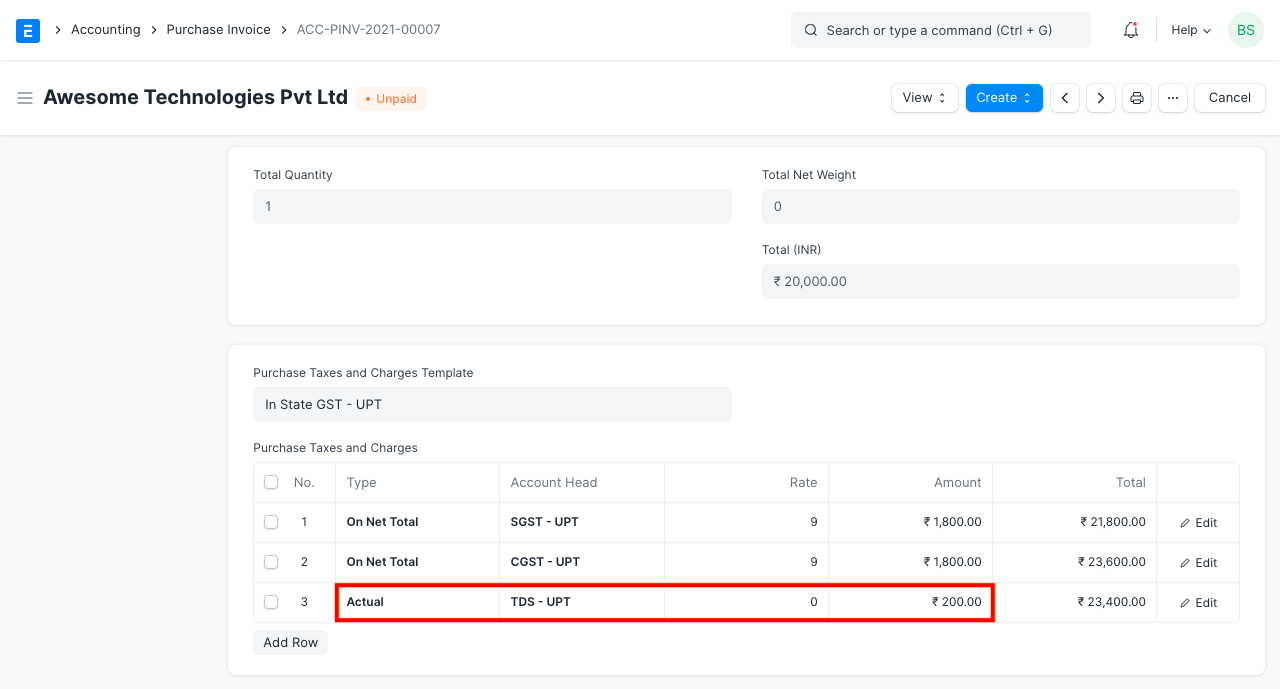

Let's create an invoice for 20,000. Saving the invoice automatically calculates tax and appends it in the Purchase Taxes and Charges table. Although the tax category assigned to the supplier has a tax rate of 5%, the prevailing tax rate is 1% which is mentioned in the Lower Deduction Certificate.